MONEY ID

Summer semester 2018 – Human-System-Interaction – Prof. Philipp Thesen – Victoria Lemke, Felix Lebedinzew, Cristina Talpa and Jonas Engelhardt

A study project in the field of Human-System-Interaction of the Design Department at Darmstadt University of Applied Sciences in cooperation with Neugelb Studios.

Future Banking Experience

The omnipresent digitalization has radically changed our world in recent years and questioned traditional business models. As a result of freely available information and falling transaction costs, banking in particular has come under enormous pressure: ATMs, automated payment transactions, online banking and AI-controlled investment advice make visiting a bank branch and talking to a bank advisor superfluous for many people.

Banks are evolving from being indispensable carriers of know-how into vicarious agents. So what can the banking of the future look like in a digitalized world that will create value for customers and companies alike? This is the question students of the Design Department at Darmstadt University of Applied Sciences are asking themselves in cooperation with Neugelb Studios, the internal service design agency of Commerzbank.

Situation

Commerzbank commands a large network of analog and digital touch points for their customers. However these contact points are not well connected and work partially independent of each other. In different scenarios the customer has to state and explain his requests over and over again at each touch point.

We want to optimize

the interaction between

the touch points on

differnt layers.

Complication

This leads to a tremendous redundancy of everyday procedures and small as well as bigger requests can only hardly be processed seamlessly through multiple touch points. This condition shows a big potential for optimisation, in which all touch points could have access to centralised banking-data and thus be connected to each other. As a result emerges the opportunity to offer the customer a consistent positive user experience through all touch points.

Solution

We want to give the customer a seamless experience through all channels and touch points of Commerzbank with the help of an universal account, the banking ID. With a centralised data backup in the cloud, all channels can operate autonomous or in perfect synchronisation. As a result all information about initiated processes and finished steps will be tracked and passed on from channel to channel (blockchain in banking).

A simple moment

to connect

your banking ID

Wherever you are, with any device.

Be independent

With his banking ID, the customer can take care of every banking activities through the channel that is available at the moment, independent of place or device. He identifies through a biometric verification process like fingerprint scan or face recognition. These methods have proved to be more secure than passwords or PIN numbers and are also more time efficient in their usage. We therefore don’t want to expand the current banking system with new channels, but to change the way how customers interact with Commerzbank through many different touch points.

Use cases

When getting cash is easy.

No matter where, no matter who.

If the user is looking for cash, he can look for different options in the new banking app. He will then get results depending on his current location, most common ones such as an ATM or the branch. A new possibility is to get cash from smaller shops. The user would then get the information on who’s in charge to hand him the money and get navigated to the shop. The shop would get a notification that he’s on his way and once he arrives, he identifies trough MONEY ID. As soon as he gets the cash handed over, the money is automatically transferred from his bank account to the shop’s.

When visiting the branch becomes a seamless experience.

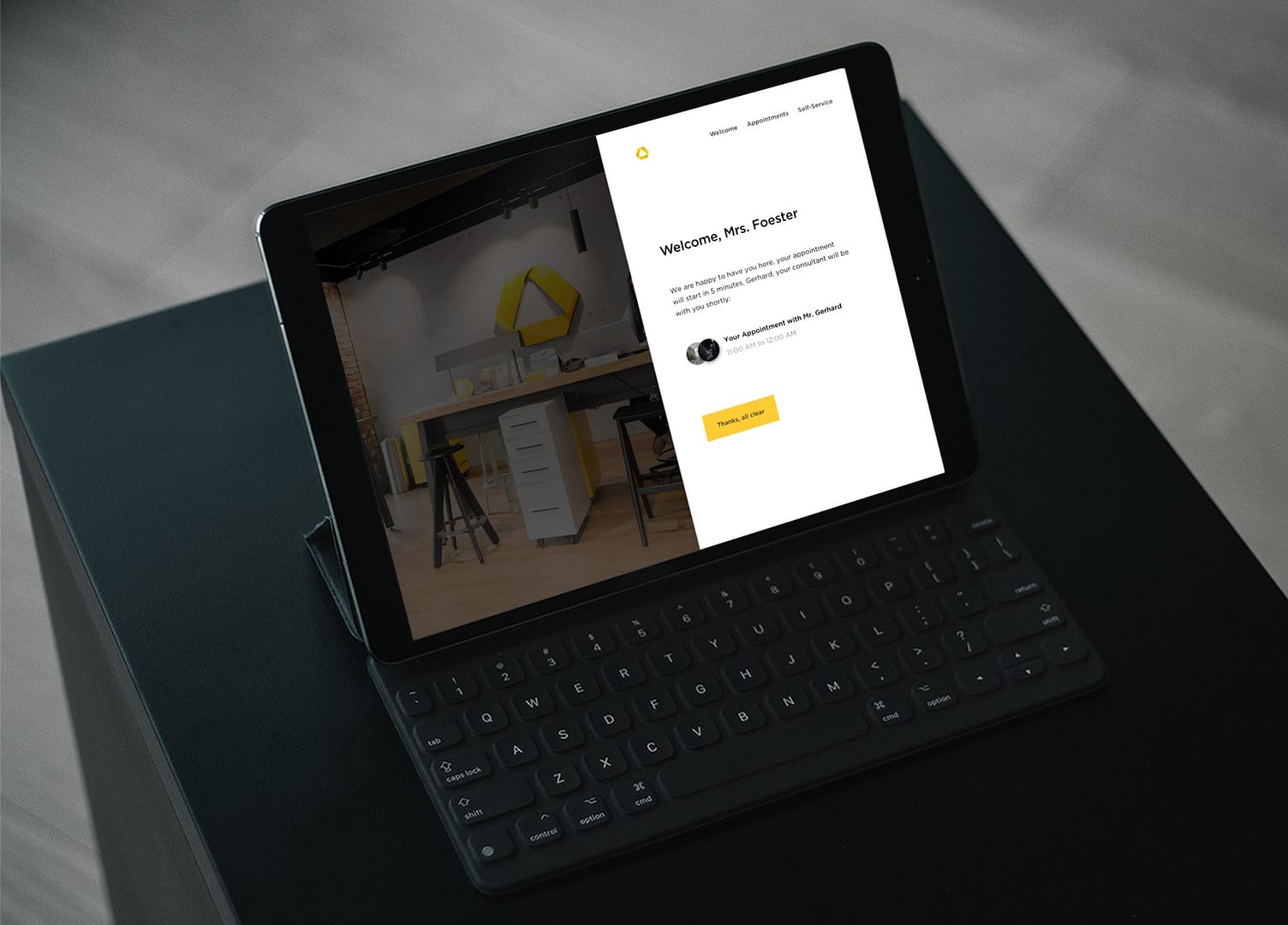

While branch visits were previously characterized by redundant procedures, such as explaining one’s request and identifying oneself, this process can be simplified considerably with MONEYID. By means of an RFID reader in the entrance area of the store, which can read the MONEYID chip, employees immediately know who is entering the store. This enables automated personalized greetings in the reception area. By consciously identifying the user at the counter, he or she is immediately shown dates, time and place. This means that one immediately receives precise information without having to explain and ask for it.

When opening a shared account is

as simple as settting up a WhatsApp group.

A simple bump to connect procedure automatically starts the search for other users in the vicinity. One of them selects the members and creates the joint account, which is immediately added to the top bar. The app clearly displays expenses and payments into the joint account.

If you want to make a joint purchase as a circle of friends, for example Playstation as a shared flat, this can also be done directly in the app. Bills can be shared directly with friends using the same principle. You select the persons concerned and the amount is automatically divided and the shares are debited to the individual accounts (second screen).

Presentation

The cooperation program included a research excursion lasting several days, including customer interviews in Berlin bank branches, as well as a one-week innovation workshop in Portugal, where the group worked intensively on product and service ideas. The prototyping and implementation phase took place in two-week sprints. The grand finale then took place in July 2019 on the 38th floor of the Commerzbank Tower, where we presented the concepts and prototypes to the bank’s marketing board.

PAGE – publication

As part of the cooperation, a contribution on Digital System Design was published in the publication series PAGE connect creative competence on the job description of Digital System Designers and on Digital System Design in Practice. The dossier can be downloaded here.

You might also like

Inflabi

Hands On Cycle

Hands On CycleWinter semester 2020/2021 – Diploma Cooperation – HP Velotechnik – Prof. Tom Philipps – Jonas EngelhardtHands On Cycle is a user-friendly touring handcycle that includes people with limited physical functions (e.g. paraplegics) by enabling them to enjoy...

Cumbuca

Foodtruck concept for homeless people in need. São Paulo – USP.